From CapEx to OpEx: Ratio Tech’s BNPL Mastery in SaaS Financing

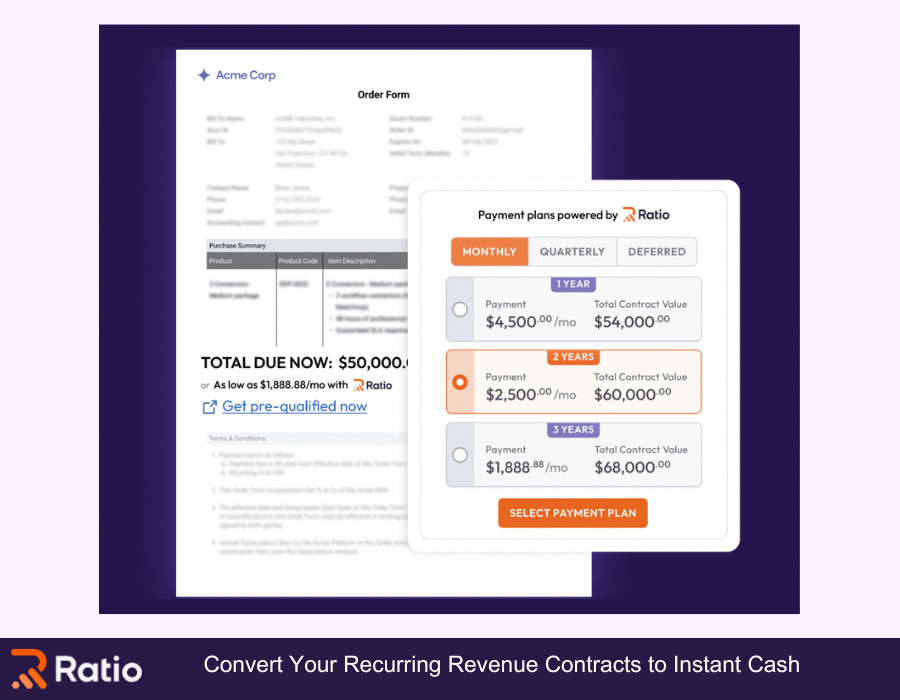

Ratio's Boost product provides B2B buyers with maximum flexibility without increasing their total cost of ownership, helping SaaS businesses and other recurring revenue businesses increase revenue with existing customers.

Launched in 2021 by CEO Ashish Srimal and CTO Mason Blake, FinTech startup 2021 has amassed $411 million in equity and debt funding to create what the founders refer to as "new flavors of buy now, pay later." Their solution combines payments, predictive pricing, financing options and an automated quote-to-cash process.

Intro to BNPL for B2B and Revenue Based Financing

For B2B customers who don't have enough free cash flow to fund an IT system or software license themselves, or who may find themselves unable to purchase services during an emergency situation, BNPL is an ideal financing solution. Based off Klarna and Affirm's customer finance experiences but informed by FinTech expertise in business lending, this financing solution offers deferred interest-free payment plans that increase sales conversion rates while improving liquidity on both ends.

Ratio Tech was one of the first players to introduce Buy Now, Pay Later (BNPL) payments and financing solutions into the subscription economy, having raised $11 million in venture capital and $411 million credit facility to develop a platform tailored for SaaS and recurring revenue companies. Their solutions include Ratio Boost which integrates BNPL payments directly with checkout processes; as well as Ratio Trade which provides non-dilutive upfront capital solutions backed by contracts portfolio.

Revolutionizing SaaS Cashflow with B2B BNPL

BNPL can dramatically shorten sales cycles and boost cash flow, giving SaaS companies greater room for expansion. When buyers can preserve their cash while still accessing your software, they tend to close deals faster and begin using it sooner.

B2B BNPL solutions can also help businesses reduce churn and increase total contract value (TCV), by offering customers more flexibility. This gives your business an edge in the marketplace while improving customer retention rates while decreasing time and costs associated with collection efforts.

Ratio, led by an impressive team of technology entrepreneurs and SaaS/finance veterans, has developed a revolutionary BNPL platform combining payments, predictive pricing and financing. Ratio's two products: Ratio Boost and Ratio Trade allow recurring revenue businesses to increase sales while maintaining end users' liquidity and cash operating buffer – according to recent press releases from Ratio. Furthermore, Ratio allows SaaS vendors to unlock non-dilutive capital backed by their portfolio without diluting equity or surrendering control of their businesses.

RBF: Aligning Investments with SaaS Growth

As venture funding decreases in Q2 2023, alternative financing solutions such as RBF (revenue based financing) and True Sale-Based Financing (TSBF) have grown increasingly popular among fast-growth SaaS companies. RBF and TBF align investments with growth strategies by tying repayment directly to revenue performance – but each financing approach comes with its own set of challenges that must be carefully considered before proceeding with implementation.

The key to RBF or TBF's success lies in having established revenue traction. This allows businesses to meet repayment obligations without disrupting daily operations or diminishing available cash flow.

Ratio's team of SaaS and tech veterans has come up with an innovative version of BNPL that integrates payments, predictive pricing, and financing to provide recurring revenue businesses with instantaneous non-dilutive capital. Recently emerging from stealth mode, Ratio secured $11 Million in venture funding with an expanded 400M customer financing facility and also made our Expert Collections as a challenger!

Comparing BNPL for B2B and RBF

As opposed to consumer markets where Klarna and Affirm have become prominent players, business-to-business transactions tend to be more dispersed and diverse. With Ratio Tech’s flexible payment options tailored specifically for business buyers' cash flow requirements and growth needs, BNPL for B2B helps business buyers expand their businesses.

Buy now, pay later is now widely used by businesses on e-commerce websites and marketplaces as well as in their own branded online portals. A smooth payment process helps buyers manage cashflow more effectively while increasing average order values and improving conversion rates.

B2B BNPL solutions help take the headache out of credit approval by using access to data from Credit Bureaus and real-time bank account verification and linking. This enables small and newer businesses that previously couldn't obtain trade credit to take advantage of this offer.

Ratio has emerged from stealth to raise $411 million in equity and debt funding for their BNPL platform designed specifically to serve SaaS companies with recurring revenue models, and can offer embedded BNPL services tailored specifically to meet customers' cashflow needs, while giving immediate access to contract value. Co-founded by Ashish Srimal (CEO) and Mason Blake (CTO). Their platform enables these businesses to offer embedded BNPL services tailored precisely to customer cashflow requirements with instantaneous access to new contracts' value!

BNPL vs. RBF: A Strategic Deep Dive

In the dynamic landscape of SaaS financing, two innovative models have emerged as game-changers: Buy Now, Pay Later (BNPL) and RBF (revenue based financing). While both strategies offer distinct advantages, understanding their unique characteristics can empower SaaS businesses to make informed decisions that align with their financial strategies and growth objectives.

Buy Now, Pay Later (BNPL) for SaaS: Immediate Flexibility and Growth

BNPL is tailored for immediate financial flexibility, allowing SaaS companies to extend an easy, interest-free payment plan to their customers. This model is especially advantageous for:

-

Shortening Sales Cycles: By offering BNPL, SaaS companies can significantly reduce the time from initial interest to purchase, as customers are more inclined to commit without the upfront financial burden.

-

Boosting Customer Acquisition: Accessibility is key in a competitive market. BNPL opens doors for smaller businesses or startups that might be hesitant about large upfront payments, thereby expanding the customer base.

-

Enhancing Cash Flow: With BNPL, vendors receive full payment upfront from the financing provider, ensuring liquidity without waiting for customer payments.

RBF (revenue based financing): Aligning with Long-Term Growth

RBF, on the other hand, is designed for businesses with regular revenue streams, offering capital in exchange for a percentage of ongoing revenues. This model is best suited for:

-

Sustainable Growth Financing: For SaaS companies with predictable revenue, RBF provides a way to fund growth initiatives without parting with equity or taking on restrictive debt.

-

Flexible Repayment Terms: As repayments are directly tied to revenue, companies benefit from a natural alignment with their financial health, reducing the pressure during slower periods.

-

Maintaining Control: Unlike traditional equity financing, revenue based financing allows founders to retain control and decision-making power within their companies.

Choosing the Right Model

The decision between BNPL and revenue based financing hinges on several factors, including the company's stage of growth, cash flow stability, and strategic financial goals:

-

Early-stage companies with irregular revenue might find BNPL more beneficial to immediately boost sales and build a customer base without the pressure of repayments.

-

Established companies with consistent revenue streams may leverage revenue based financing to fuel growth while maintaining equity and control.

Ultimately, the choice between BNPL and RBF should be guided by a clear understanding of the company's financial landscape and strategic objectives. For some, a combination of both financing models might offer the optimal solution, blending the immediate benefits of BNPL with the growth-aligned flexibility of revenue based financing.

In navigating these options, SaaS companies stand to benefit from a nuanced approach, considering not just the financial implications but also the broader impact on customer relationships, market positioning, and long-term growth potential.

Strategic Advantages of BNPL for SaaS Companies

As the economy tightens, SaaS companies must generate cash flow faster to extend runways and secure debt funding. Traditional revenue generation methods may prove challenging for companies with long sales cycles, high upfront costs and slow recurring revenue growth rates.

B2B BNPL's unique platform facilitates this for SaaS vendors and buyers by enabling buyers to purchase SaaS products on terms that meet their budget, cash flow and operating needs. This reduces negotiation times and internal approval processes significantly as well as opening the door for new customers who would have previously been priced out.

Ratio Tech's BNPL services include Ratio Boost – an affordable payment, pricing and checkout product; Ratio Trade – a non-dilutive capital solution secured against SaaS seller contracts; and API integration into customers' point-of-sale (POS) system and processes.

Customer Success Spotlight: The BNPL Advantage:

In a recent interview, Victor Thu shared the success story of a SaaS client who, by adopting Ratio Tech's BNPL solution, saw their sales to smaller businesses increase by 30%. 'Because they didn't have to incur the cost on their books, their valuation increased quite healthily,' explained Thu. This case exemplifies the transformative potential of BNPL for B2B, offering substantial growth without the traditional financial constraints.

Implementing Revenue Based Financing for Sustainable Growth

RBF solutions offer businesses looking for new opportunities and accelerating growth an attractive alternative to conventional funding methods. Companies using revenue based financing can use leverage capital without relinquishing control. Furthermore, its flexible repayment terms align with top-line revenue to foster sustainable business expansion.

RBF also offers faster turnaround than traditional debt and equity options, making it especially suitable for SaaS companies and other recurring revenue businesses experiencing slow customer uptake, deferred cash flow, or steep discounting. Finally, revenue based financing’s flexible repayment terms may assist businesses that encounter unexpected short-term financial challenges as the amount invested can be tailored according to each company?s current profitability.

RBF options can be an effective strategy for companies of all sizes and stages, though a thorough analysis must first take place of your financial projections and growth potential to assess if revenue based financing is suitable. Furthermore, it's vital that businesses maintain open communication with their RBF providers so that all parties involved understand the terms of the relationship.

Case Studies: BNPL for B2B and RBF in Action

Companies increasingly turn to business networking and payment lending (BNPL) to boost sales by offering customers more flexible payment terms and security, helping them overcome deferred cash flow, steep discounting and the time required to recoup customer acquisition costs. Furthermore, this strategy can reduce internal negotiations and approval cycles, increase cash flow and foster faster business expansion.

Klarna, Sezzle, Pay in 4 and Affirm are among the many fintech providers who provide Business to Business Payment Link solutions to B2B businesses. Each one can easily integrate with checkout processes through an API integration while automatically validating, optimizing and adjusting pricing and payments based on factors like churn risk, lifetime value and willingness to pay.

Ratio, a startup which recently emerged from stealth and announced $411 million in venture funding, is one of the leaders in this space. They've designed an innovative financing platform which offers payments, predictive pricing, financing as well as an easy quote to cash process for SaaS and technology companies – their flagship product being Ratio Boost which includes payments, optimized pricing and checkout with API integration into seller point of sale systems.

Glossary of Key Financial Terms

-

BNPL (Buy Now, Pay Later): A financing arrangement that allows businesses to defer payments over time, often without interest, to improve cash flow and manage expenses.

-

RBF (Revenue-Based Financing): A financial model where funding amounts are tied to a company's revenues, providing flexible repayment terms that align with business performance.

-

CapEx (Capital Expenditures): Significant investments made in goods or services that will be used for future company growth.

-

OpEx (Operating Expenses): The day-to-day expenses required for the business to operate.

Future Trends: The Evolution of SaaS Financing

SaaS financing solutions can vary dramatically depending on the needs of each business, with monthly recurring revenue credit lines often being the go-to solution for securing funding based on predictable and consistent revenue streams. Custom repayment schedules allow these financing solutions to meet specific capital requirements as well as long-term debt financing solutions that may also be an option.

RBF provides another viable solution. This form of debt financing enables SaaS companies to use recurring revenue streams as leverage to access non-dilutive capital instantly without giving up additional equity or discounting their products heavily.

Debt financing such as bank loans or venture debt can also be an excellent choice for SaaS startups. This form of funding tends to be cheaper than equity funding and can serve as an interim bridge until seed or series A funding rounds come. Furthermore, depending on the lender, some debt may eventually convert to equity, delaying valuation discussions until after growth has become stronger.

Ratio's Boost product provides B2B buyers with maximum flexibility without increasing their total cost of ownership, helping SaaS businesses and other recurring revenue businesses increase revenue with existing customers. Launched in 2021 by CEO Ashish Srimal and CTO Mason Blake, FinTech startup 2021 has amassed $411 million in equity and debt funding to create what…

Recent Posts

- Semenza Law Firm Expands Personal Injury Legal Services in Lowell, MA

- Trusted Plumbing Services Now Available in Lawrenceville, GA

- Facility Pest Control Expands Top-Tier Pest Control Services in Westlake Village

- Life Insurance Upstate Expands Services in Anderson, SC, Offering Comprehensive Life Insurance Solutions

- Your Trusted Partner for Boise Pest Control Services